May 15, 2021 – Since the start of the pandemic, net-lease real estate has gone through a time of uncertainty while investors determine how the market will shift. However, during this time of hesitation from investors, the market for investment grade, single-tenant assets has remained strong. Credit tenants contain a credit rating of BBB- or higher from credit rating agencies such as Standard & Poor’s and Moody’s. Private and institutional investors view these assets as less risky while producing stable returns.

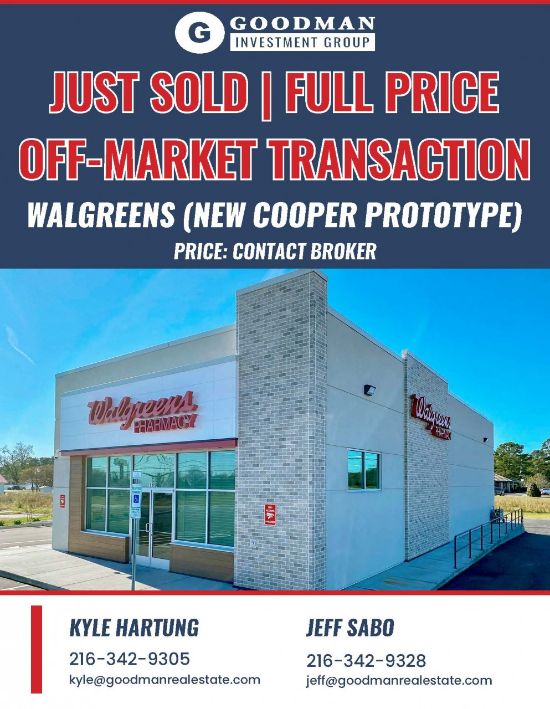

The Goodman Investment Group has closed numerous single-tenant net-lease assets since the start of the pandemic that contain a strong credit rating. Recently, the Goodman Investment Group sold an off-market Walgreens to a West Coast- based private buyer at full ask price for a repeat client.

Please inquire directly with Kyle Hartung or Jeff Sabo for information regarding other net-lease assets for sale.